Switching from the NEDC standard to the WLTP standard to calculate the consumption and emissions of a vehicle does have an impact on the level of taxation and deductibility of the vehicles. Explanations.

What is the WLTP standard?

The WLTP (Worldwide Harmonised Light Vehicle Test Procedure) standard is a new cycle that has been deployed worldwide. It is used to measure fuel consumption, CO2 emissions and pollutant gases from light vehicles. The WLTP certification standard replaces the former NEDC standard that has been in force in Europe since 1973. The WLTP standard has been made mandatory since 1 September 2018 for all new passenger cars and from 1 September 2019 for commercial vehicles.

What has changed with the WLTP?

The WLTP cycle is intended to provide test conditions that are more representative of actual driving. In fact, the NEDC procedure was deemed too theoretical. The aim is to provide more accurate values for fuel consumption and CO2 and nitrogen oxide (NOx) emissions that are closer to the realities experienced by consumers.

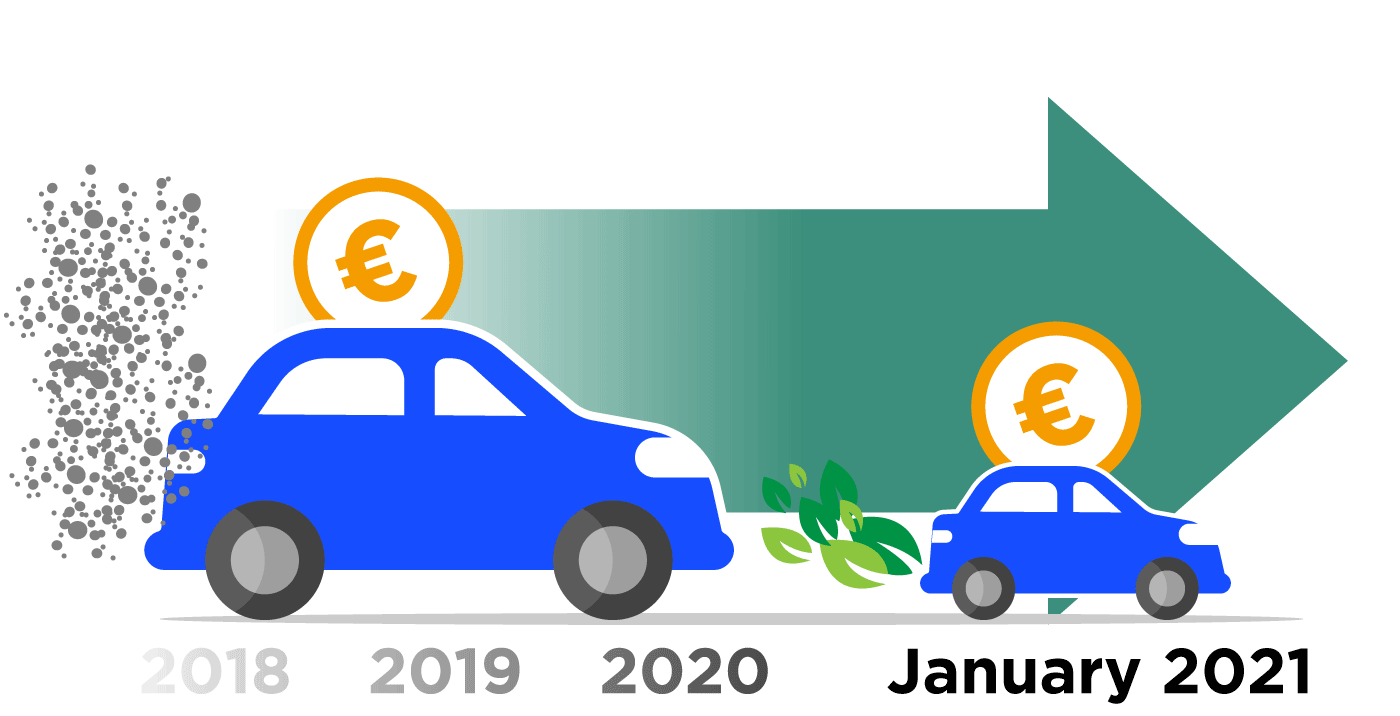

This new way of measuring cars generally leads to an increase in the “official” consumption of vehicles. For a conventional vehicle, this is estimated to be 1.3 litres/100km on average, i.e. an increase of between 20% and 30%. This increase therefore also applies to CO2emissions, which are directly related to fuel consumption.

The WLTP standard in Belgium

In Belgium, the taxation of your vehicle is partly based on its CO2 emissions. The change from the NEDC standard to the WLTP standard since 1 January 2021 has therefore had a negative impact on the consumer’s wallet; if they wish to keep paying the same level of taxation, they have had to turn to a smaller vehicle and/or one that has lower emissions.

Only Flanders has already adapted its emissions calculation to the WLTP standard. In Wallonia, you can still use the NEDC value for the CO2 eco premium that accompanies the road tax, as long as it is mentioned on the vehicle certificate. In Brussels, CO2 does not (yet) play a role when it comes to taxing private cars.

The WLTP standard for self-employed and company cars

The WLTP standard has a higher emission value, resulting in higher taxes for the self-employed or company car users. With a higher CO2 value, the deductibility of the vehicle and the associated costs are reduced. This will also affect the calculation of the benefit in kind (avantage toute nature – ATN) which will also be higher (for the same model). So you need to pay special attention to the WLTP values when you buy or lease.