Light commercial vehicles (LCVs) are subject to a different tax regime than cars. There is no registration fee and the annual fee is based on weight. However, an important change is taking place in Wallonia in 2022. An LCV used privately will now be taxed like a car.

Vans (light commercial vehicles) of up to 3.5 tonnes are entitled to specific taxation. Since they are generally used for professional purposes, they can benefit from a 100% VAT deduction, in proportion to their private use (minimum 50% deduction). Costs and investments are 100% deductible (75% if private use).

LCVs are also exempt from tax on registration of the vehicle. Take note, though: in Wallonia, since 2022, if the buyer cannot prove professional use of the vehicle (BCE company number or liberal profession needing a LCV), they will have to pay the same taxes as a car.

In Flanders

There is no tax on registration of the vehicle (BIV). The annual tax for a new LCV of up to 2.5 tonnes is €20.40 per 500 kg of maximum authorised mass. This rate will be weighted according to CO2 emissions (WLTP standard). In fact, this rate is increased or decreased by 0.30% for each gram of CO2 per kilometre above or below 122g (with a minimum cap of 24g and a maximum of 500g). For a van of more than 2.5 tonnes, the basic amount is unchanged for a new Euro 6 vehicle. The minimum amount of tax is €46.53. For commercial vehicles that do not meet the Euro 6 standards or were registered for the first time before 1st July 2017, the calculation is different. It then takes into account the Euro standard and the presence of a particulate filter: ask the Flemish public service for more information.

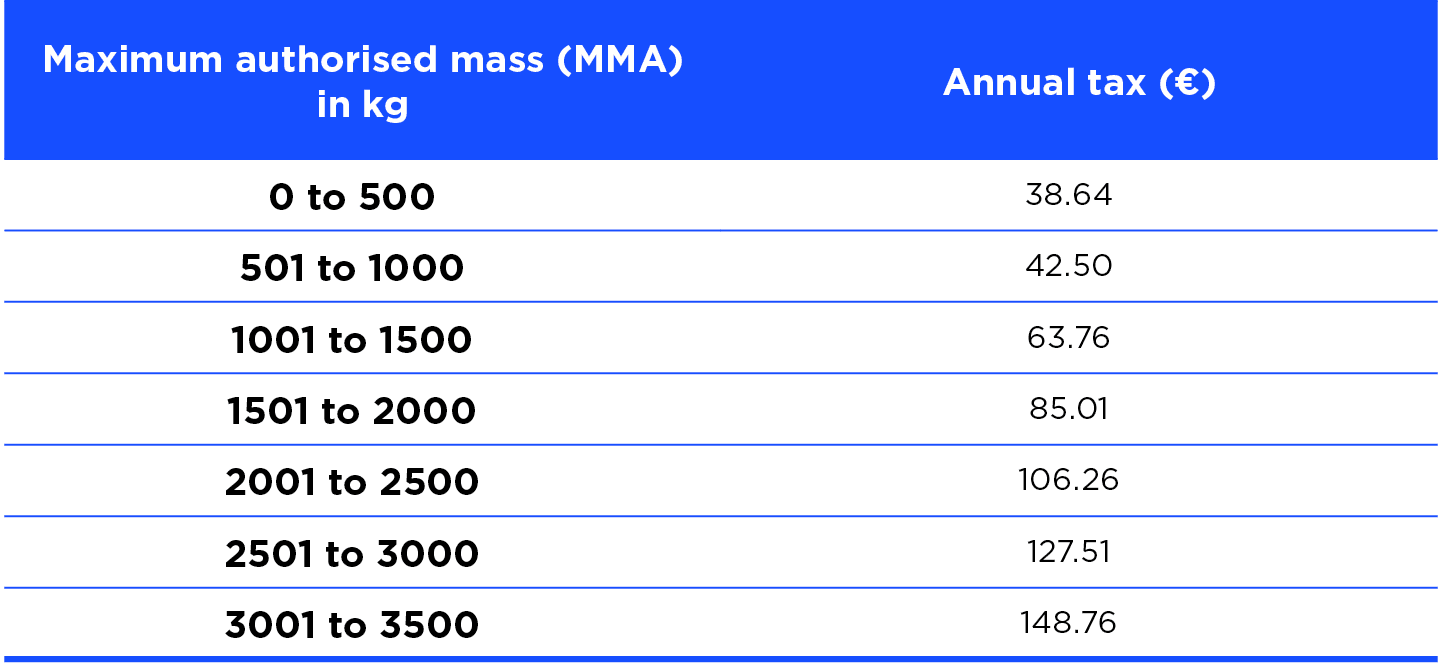

Please note: vans included in a leasing contract are taxed according to the table below (at the expense of the leasing company).

In Wallonia

There is no tax on registration of the vehicle (TMC), nor eco-surcharge if the vehicle is used in a professional context (ECB business number or liberal profession requiring the use of a LCV). The annual road tax is based on weight for professional use (see table below). An LCV used by a private individual is taxed like a car (depending on the cubic capacity and power), with TMC and eco-surcharge. This regulation is mainly aimed at pick-up trucks.

In Brussels

No tax on registration of the vehicle (TMC). The annual road tax is based on weight (see table below).